Home >

Fiscal law >

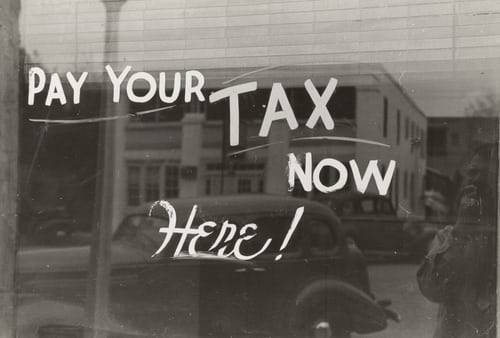

2023 French income tax return and 2024 real estate wealth tax

2023 French income tax return and 2024 real estate wealth tax

Filing of the 2023 French income tax declarations and 2024 French real estate wealth tax.

The French tax specialist law firm CM-Tax and its team of English speaking French tax advisors, based in Lyon and Marseille but operating throughout France, assists French residents and non-residents so that everyone can meet their reporting obligations .

Our team of French tax experts is at your disposal to establish:

This declaration assistance is accompanied by specialized advice on matters such as:

The rules of tax law relating to declarations are often complex; CM-Tax's expertise in tax law, with an extensive experience in a wide variety of situations, in a national or international context, guarantees you a professional, pragmatic and relevant approach.

The French tax specialist law firm CM-Tax and its team of English speaking French tax advisors, based in Lyon, Marseille and Toulon but operating throughout France, advises and assists on all subjects relating to tax law - tax advice and tax litigation - as well as property law. We also assist tne international community in the sale and acquisition of French real estate.

The French tax specialist law firm CM-Tax and its team of English speaking French tax advisors, based in Lyon and Marseille but operating throughout France, assists French residents and non-residents so that everyone can meet their reporting obligations .

Our team of French tax experts is at your disposal to establish:

- the declaration of income received during the year 2023;

- the declaration of the value of your real estate assets on January 1, 2024 (Tax on real estate wealth - IFI 2024).

This declaration assistance is accompanied by specialized advice on matters such as:

- income received abroad (application of international conventions);

- rental incomes;

- capital gains;

- revenue from cryptocurrencies;

- evaluation of the market value of your real estate.

The rules of tax law relating to declarations are often complex; CM-Tax's expertise in tax law, with an extensive experience in a wide variety of situations, in a national or international context, guarantees you a professional, pragmatic and relevant approach.

The French tax specialist law firm CM-Tax and its team of English speaking French tax advisors, based in Lyon, Marseille and Toulon but operating throughout France, advises and assists on all subjects relating to tax law - tax advice and tax litigation - as well as property law. We also assist tne international community in the sale and acquisition of French real estate.

Discover +

How to determine your tax residence?

Importance of the concept of tax residence The determination of tax residence (or even tax domicile) is a key point which largely determines the tax obligations of an individual vis-à-vis a State, whether with regards to income tax, the taxation of capital gains or even gift or inheritance ... More detailsnavigate_next

Regularization of bank accounts held abroad

The French tax specialist law firm CM-Tax and its team of English speaking French tax advisors, based in Lyon and Marseille but operating throughout France, can assist you with the procedures related to the tax regularisation and declaration of your financial assets held abroad and related... More detailsnavigate_next