Law firm specialized in French tax and legal advice

CM-Tax is an independent law firm in Lyon and Marseille, France specialized in:

- French tax advice and tax litigation;

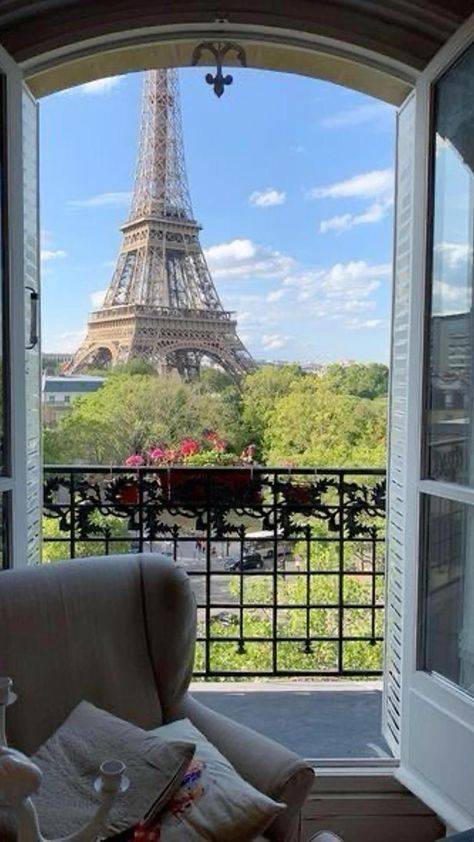

- French property law;

- French real estate transactions: advice and backing, sale and purchase of real estate assets.

We operate in both French and international contexts.

The French tax specialist law firm CM-Tax and its team of English speaking French tax and legal advisors, based in Lyon and Marseille but operating throughout France, advises and assists on all subjects relating to French tax law - tax advice and tax litigation - as well as French property law. We also assist the international community in the sale and acquisition of French real estate.

Founded in 2007, CM-Tax regularly and/or punctually supports and assists its clients in the field of taxation in France, both from the point of view of advice, as well as exchanges with the administration and litigation.

This solid level of expertise in tax law makes it possible to assist and advise a very diversified clientele, French and international, whether companies, individuals or various organizations such as non-profit organizations or trusts.

We are always very happy to assist members of the international community in the defense of their interests and the respect of their tax and legal obligations in France, so as to facilitate their operations and their investments in France.

Anxious to follow the needs of its clients and prospects, CM-Tax has expanded its offer by creating a property law department, then a French real estate department.

Thus, each client has the opportunity to be accompanied by a single interlocutor throughout his project whether it is real estate investment, management/transmission of heritage or business, protection of family both in terms of civil law and tax law.

Our firm regularly works in partnership with foreign law firms, notaries, accounting firms and family offices.

CM-Tax is a member of SAJEF group, made up of lawyers specializing in business law, social law, litigation and insolvency proceedings, which allows it to provide its expertise in France to its clients both privately and professionally.

Composed of about fifteen professionals, the multidisciplinary team is at your disposal to provide all the care necessary for the realization of your projects.

We work in collaboration with niche law firms specializing in business and corporate law, which allows us to assist our clients with business transfers, mergers and other restructuring operations.

Our team works with a clientele of individuals and companies both in France and abroad.

We speak French and English.