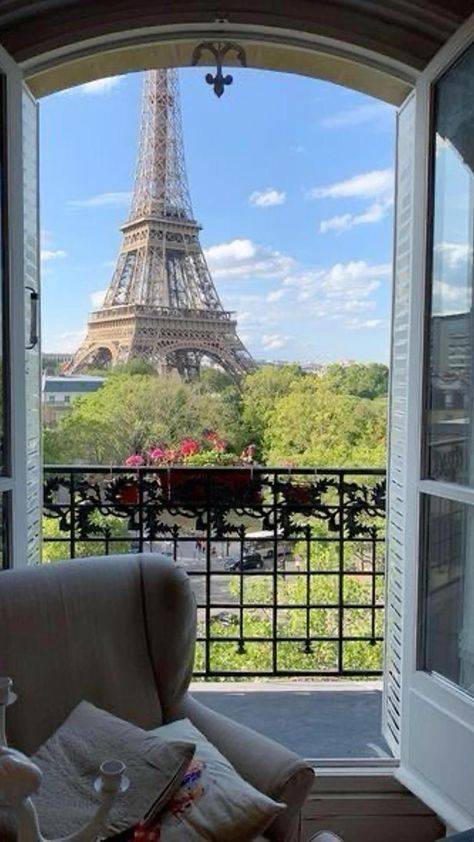

Inheritance tax advice for expats France Nice French Riviera

Inheritance tax advice for expats France Nice French Riviera

How to determine your tax residence?

Importance of the concept of tax residence The determination of tax residence (or even tax domicile) is a key point which largely determines the tax obligations of an individual vis-à-vis a State, whether with regards to income tax, the taxation of capital gains or even gift or inheritance ... More detailsnavigate_next

Tax implications for individuals relocating to France

If you are considering relocating to France, it is essential to understand the tax implications that come with becoming a fiscal resident in the country. France has a comprehensive tax system, which includes obligations related to income tax, social contributions, and wealth tax on real estate.... More detailsnavigate_next

International successions: what are your obligations in France?

The settlement of inheritances with a foreign character is not easy and the related tax obligations are not well known.The question of the territoriality of inheritance tax is dealth with by article 750 ter of the French tax code.Thus, two hypotheses should be distinguished: the deceased was... More detailsnavigate_next

2019 Income tax retrun and wealth tax returns in Lyon (France)

The French Ministry for the Economy and Finance announced on April 1st, 2020 that the deadline for filling the French personal income tax declaration, initially fixed April, 8th 2020, is postponed due to the Corona-virus lock-down situation.In case your French personal income tax return is filed... More detailsnavigate_next

Trusts - filing and tax obligations

Trusts, even if unknown by French civil law, is not ignored by French tax rules.The French tax specialist law firm CM-Tax and its team of English speaking French tax advisors, based in Lyon and Marseille but operating throughout France, advises and assists on all subjects relating to French tax... More detailsnavigate_nextYou would like to buy or sell a property in France and are looking for a French real estate advisor? CM Tax is a company specialized in legal and tax assistance for real estate. Located in Lyon, this law firm offers its services to individuals and professionals throughout France.

Browse through the website to discover the various services offered by CM Tax.

Our services in the sector of

Nice French Riviera

Our area of activity for this service