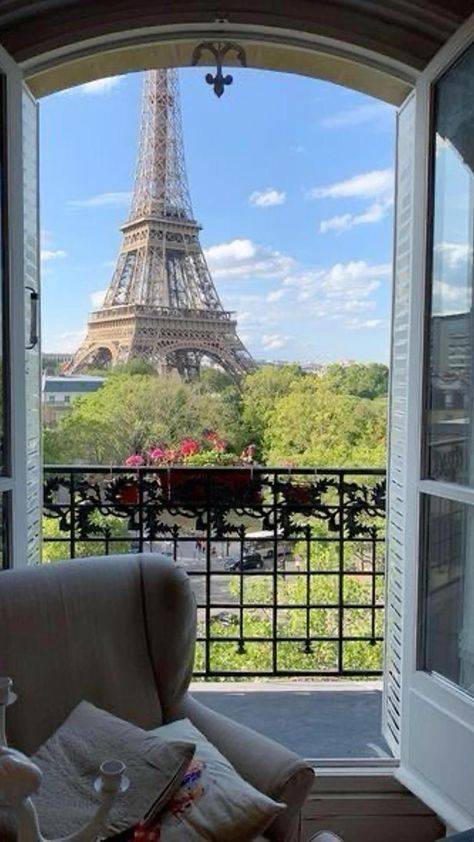

French tax expert NIce, French RIviera

New tax treaty between France and Greece

The new tax treaty concluded on May 11, 2022, between France and Greece was published by a decree on January 9, 2024; it entered into force on December 30, 2023.It replaces the tax treaty of August 21, 1963.This new tax treaty largely incorporates the provisions of the OECD model convention.A few...

More details

Sale of real estate abroad by a tax resident of France: is any tax due in France?

Do individuals domiciled in France for tax purposes have tax obligations in France when they sell property located abroad, and is capital gain tax due in France?This question is often ignored, considering that French taxation is inapplicable to the sale of foreign real estate, but this is...

More details

Trusts - filing and tax obligations

Trusts, even if unknown by French civil law, is not ignored by French tax rules.The French tax specialist law firm CM-Tax and its team of English speaking French tax advisors, based in Lyon and Marseille but operating throughout France, advises and assists on all subjects relating to French tax...

More details

TAX DISPUTES

CM-Tax law firm can assist you with your tax disputes:

- contentious claims following a procedure to rectify one's tax situation or for reimbursement of the overpayment of taxes (errors in the interpretation of tax law, changes in French or European case law, etc.);

- assistance and representation before the French Courts: Tribunal de Grande Instance, Cour d'Appel, Tribunal Administratif, or Cour Administrative d'Appel.

CM-Tax law firm, based in Lyon and Aix en Provence, assist his clients all over France especially in Nice, the French riviera and Paris.

- contentious claims following a procedure to rectify one's tax situation or for reimbursement of the overpayment of taxes (errors in the interpretation of tax law, changes in French or European case law, etc.);

- assistance and representation before the French Courts: Tribunal de Grande Instance, Cour d'Appel, Tribunal Administratif, or Cour Administrative d'Appel.

CM-Tax law firm, based in Lyon and Aix en Provence, assist his clients all over France especially in Nice, the French riviera and Paris.

More details

Tax implications for individuals relocating to France

If you are considering relocating to France, it is essential to understand the tax implications that come with becoming a fiscal resident in the country. France has a comprehensive tax system, which includes obligations related to income tax, social contributions, and wealth tax on real estate....

More details

HOW AM I TAXED WHEN I LEAVE FRANCE ?

Leaving France is likely to result in significant tax consequences. Some income will no longer be taxed in France while other income will still be taxed. France has put in place an exit-tax system which, in principle, consists of taxing certain earnings when leaving France. Analysing the fi...

More details

Other searches

Write us

Fields marked by asterisks (*) are required

Tax expert

Experience and Proximity

International Dimension