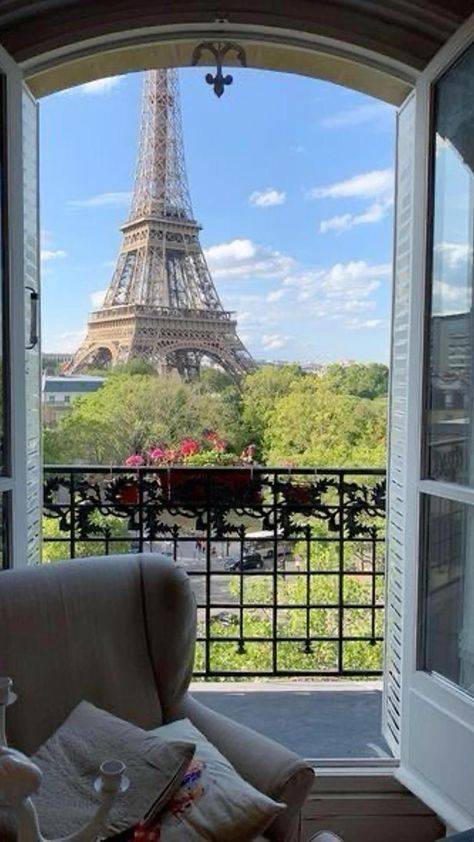

Real estate consultancy to acquire a residence Cannes

Real estate consultancy to acquire a residence Cannes

PROPERTY WEALTH TAX (IMPÔT SUR LA FORTUNE IMMOBILIÈRE - IFI)

Since 01 January 2018, Property Wealth Tax (IFI) has replaced the French Wealth Tax (Impôt de Solidarité sur la Fortune - ISF).Tax Basis.The new tax applies to any natural person who, along with his/her spouse (spouse, civil partner, or cohabitating partner) and under-age children, possesses net p... More detailsnavigate_next

HOW AM I TAXED WHEN I LEAVE FRANCE ?

Leaving France is likely to result in significant tax consequences. Some income will no longer be taxed in France while other income will still be taxed. France has put in place an exit-tax system which, in principle, consists of taxing certain earnings when leaving France. Analysing the fi... More detailsnavigate_next

WHY MAKE A DUTREIL AGREEMENT?

A Dutreil Agreement is a commitment to retain shares in companies based in France or in a foreign country, taken by several partners representing at least 34% of the share capital. When the appropriate conditions and commitments are fulfilled, it makes it possible to benefit from very important ... More detailsnavigate_next

2023 French income tax return and 2024 real estate wealth tax

Filing of the 2023 French income tax declarations and 2024 French real estate wealth tax.The French tax specialist law firm CM-Tax and its team of English speaking French tax advisors, based in Lyon and Marseille but operating throughout France, assists French residents and non-residents so that... More detailsnavigate_next

Tax implications for individuals relocating to France

If you are considering relocating to France, it is essential to understand the tax implications that come with becoming a fiscal resident in the country. France has a comprehensive tax system, which includes obligations related to income tax, social contributions, and wealth tax on real estate.... More detailsnavigate_nextYou would like to buy or sell a property in France and are looking for a French real estate advisor? CM Tax is a company specialized in legal and tax assistance for real estate. Located in Lyon, this law firm offers its services to individuals and professionals throughout France.

Browse through the website to discover the various services offered by CM Tax.

Our services in the sector of

Cannes

Our area of activity for this service