Law firm for tax audit Geneva

Law firm for tax audit Geneva

Legal and tax assistance with selling of real estate

We assist our clients to anticipate a future sale of a of French real estate or real estate company shares by monitoring their future capital gains tax exposure and legal status of the property. We assist our client during all the phases (both legal and tax) of the sale of French real estate or... More detailsnavigate_next

Legal and tax assistance with acquisitions of real estate

We assist our clients during all the phases (both legal and tax) of a French real estate acquisition transaction by : setting up a tax efficient investment structure (direct acquisition, interposing a transparent real estate company or a company liable to corporate tax) optimizing the global... More detailsnavigate_next

Regularization of bank accounts held abroad

The French tax specialist law firm CM-Tax and its team of English speaking French tax advisors, based in Lyon and Marseille but operating throughout France, can assist you with the procedures related to the tax regularisation and declaration of your financial assets held abroad and related... More detailsnavigate_next

Tax implications for individuals relocating to France

If you are considering relocating to France, it is essential to understand the tax implications that come with becoming a fiscal resident in the country. France has a comprehensive tax system, which includes obligations related to income tax, social contributions, and wealth tax on real estate.... More detailsnavigate_next

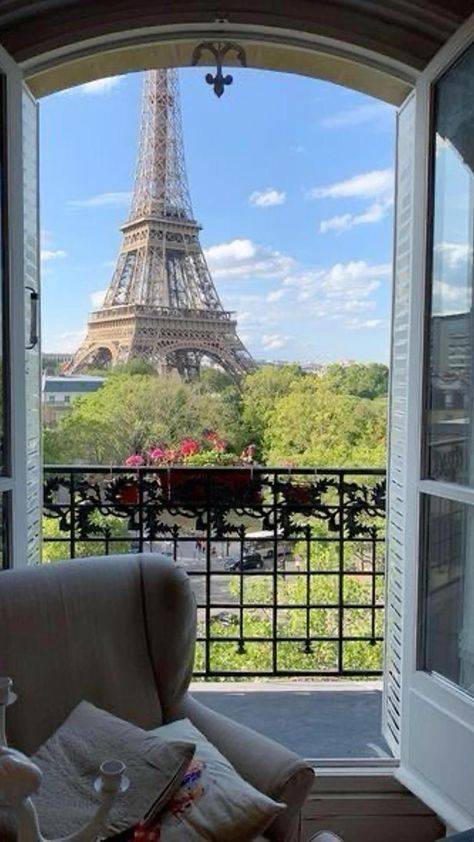

PROPERLY DECLARING YOUR FOREIGN EARNINGS

Receiving income from abroad, whether resulting from a specific activity or from financial or property investments, as well as holding bank accounts abroad or other types of assets - such as foreign property - entails specific tax obligations in France, which, if ignored, may lead to significant... More detailsnavigate_nextYou would like to buy or sell a property in France and are looking for a French real estate advisor? CM Tax is a company specialized in legal and tax assistance for real estate. Located in Lyon, this law firm offers its services to individuals and professionals throughout France.

Browse through the website to discover the various services offered by CM Tax.

Our services in the sector of

Geneva

Our area of activity for this service